Mastercard is rolling out new embedded payments technology for the freight, shipping and logistics sectors.

The rollout, announced Thursday (Oct. 10), is focused on the U.K. and Europe, and happening in partnership with Pairpoint, Vodafone and Sumitomo Corporation’s Economy of Things business.

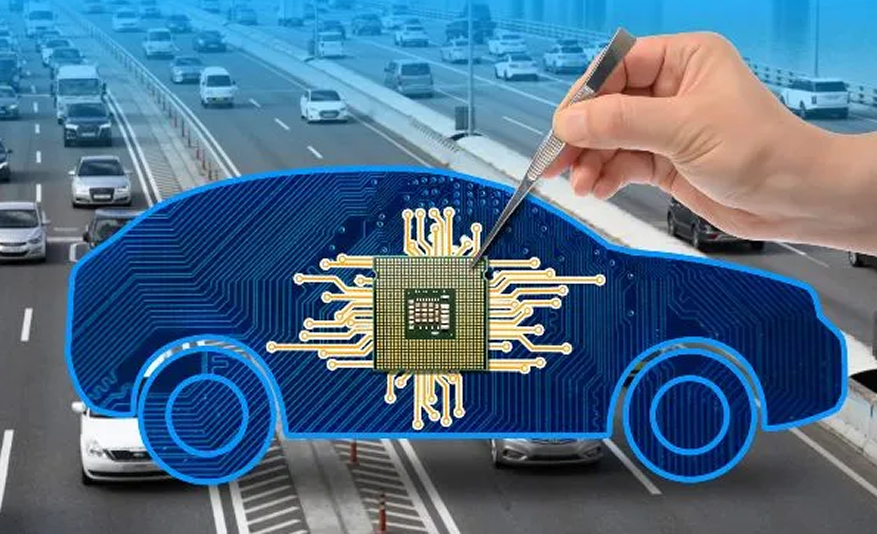

The new collaboration and payments service lets fleet, freight, shipping and logistics operators authorize smart vehicles to trade with other machines on their behalf.

“Contactless payments using smartphones are commonplace; the next step is to allow devices and vehicles to directly pick up the bill on a user’s behalf,” said Jorge Bento, CEO of Pairpoint. “This is possible through the partnership between Vodafone, Sumitomo, and Mastercard.”

The new service connects Pairpoint’s platform with Mastercard Gateway, letting fleet operators’ vehicles to make authorized direct payments at charging or fuel stations. It also allows freight companies to enable payments for pre-approved connections along a route, like port charges, handling and storage.

According to the release, Pairpoint-enabled devices will be assigned “standards-based digital identities” that are stored within their SIMs, which Pairpoint can use to allow interactions and trades with other permissioned devices using its platform.

“The service builds on existing Internet of Things (IoT) technology that enables unattended connected devices to transmit and receive data, allowing a shipping container, for example, to autonomously report its weight and free capacity,” the release said.

The collaboration taps into the scale of Vodafone’s global IoT platform, which has more 187 million connections, Sumitomo’s presence in 66 countries and regions, and Mastercard Gateway’s payment acceptance solutions, used by more than 200 financial institutions in 80-plus markets around the world.

PYMNTS discussed the rise of embedded payments earlier this year in an interview with Jennifer Marriner, executive vice president, global acceptance solutions at Mastercard.

“Embedding [payments and financial products] across the value chain and within all of the experiences that a customer is going through in that commerce environment is incredibly important,” she said.

In the B2B space, embedded payments are transforming processes that have historically been slow and inefficient. The integration of digital financial services, Marriner added, can streamline operations, lower costs and bolster risk management.

“B2B transactions have traditionally had a slower approval process, and B2B players have been slower to adopt new technology. But what we’re seeing with a shift to digital is that there is now more data, more controls, stronger authentication coming into that B2B space, all the while bringing down the cost and improving the risk models,” she said. “We’re definitely seeing on the B2B side a realization that there’s a way they can streamline their business through embedded finance.”