Intel is better positioned to sell units like Altera and Mobileye than it is to seek a 100% acquisition, according to analysts whom EE Times contacted.

Last week, Qualcomm proposed a potential buyout to Intel, according to reports in the Wall Street Journal and the Financial Times. A 100% buyout of Intel would not be a good investment because Intel Foundry will continue to have difficulty competing with larger manufacturing rivals like TSMC and Samsung, the analysts said.

“We don’t think anyone else would really want to run [Intel Foundry] and believe scrapping them is unlikely to be politically viable at this point,” Stacy Rasgon, a senior analyst at Bernstein Research, said in a Sept. 23 report he provided to EE Times. “If it was just about gaining manufacturing, Qualcomm would of course be free to use them without the headache of owning them.”

Intel Foundry’s operating loss of $2.8 billion in the second quarter this year widened from the previous quarter. The company expects operating losses at Intel Foundry to continue at approximately the same rate in the third quarter.

Intel declined to comment on the reports of acquisition talks. Earlier this month, the company said it aims to spin off Intel Foundry as an independent unit.

“Other than divesting non-core bits and pieces like Altera and Mobileye, I don’t see how Intel could just spin off one of its larger business units given they are all x86 tied,” Wedbush SVP Matthew Bryson told EE Times.

Intel acquired Altera in 2015. In February, the company declared FPGA designer Altera a standalone unit. In March 2017, Intel announced its acquisition of ADAS chip designer Mobileye. In October 2022, Intel sold about 6% of the outstanding shares in the company.

Even if Intel were to try divesting units like those designing CPUs for servers and PCs, the plan would face opposition from government regulators, according to analysts.

“Regulatory authorities would likely block a deal with any strategic buyers,” Bryson said. “There has been a hesitancy to allow large acquisitions within the space, and this deal would be larger than, say, Nvidia’s purchase of ARM.”

Market regulators scuttled Nvidia’s planned acquisition of ARM for $40 billion more than two years ago.

News of Qualcomm’s interest in acquiring Intel is a big vote of confidence, according to Dan Hutcheson, vice chair at TechInsights.

“That said, it could just be a play to save Intel by getting others like Apollo Global to invest in them,” Hutcheson told EE Times. “There are plenty of potential deal spoilers, most importantly China’s merger and acquisition regulators, as well as competitors to Qualcomm. It definitely signals to investors that there is more than a failure here and potentially a huge success.”

Intel seems to believe their future process roadmap, including 18A and beyond, is on track to drive value in the years ahead, Bernstein Research’s Rasgon said. Intel plans to start production of the 18A node in 2025.

“If it is indeed delivering, we doubt they would want a fire sale to Qualcomm,” he said. “We do not believe Intel is, at this moment, desperate for a lifeline.”

Intel’s capital expenditure cuts, operating expenditure cuts, dividend suspension, governmental subsidies and partner contributions announced this month bring about $40 billion of incremental cash onto the company’s balance sheet by the end of next year, Rasgon added.

“We believe they should have enough runway to survive for now,” he said.

Apollo Global

Asset management firm Apollo Global may be interested in taking a bigger stake in Intel. In June, Apollo announced the acquisition of a 49% equity stake in a joint venture entity related to Intel Ireland’s Fab 34 for the equivalent of $11 billion.

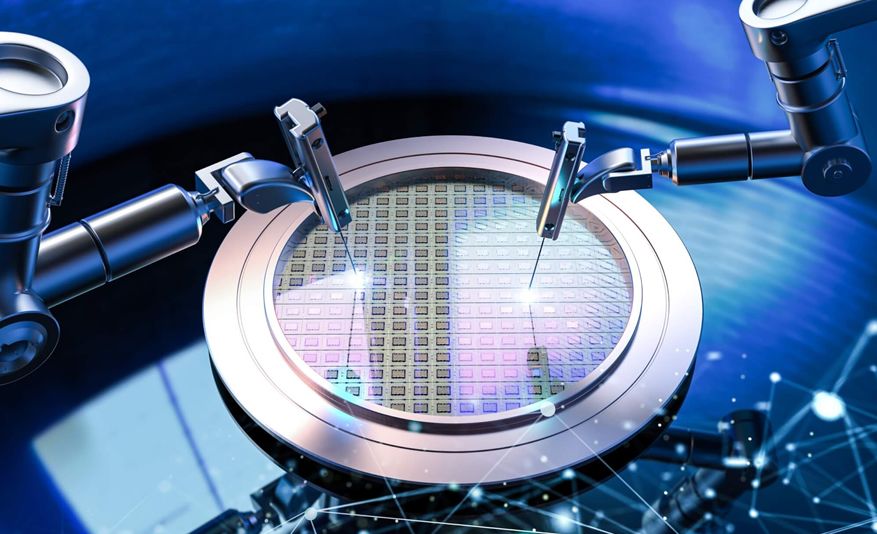

Fab 34 is Intel’s high-volume manufacturing facility producing wafers with the Intel 4 and Intel 3 process technologies. Intel has invested about $18 billion in the facility.

A photo shows Intel manufacturing employees in the cleanroom of Fab 34, the newest Intel manufacturing facility in Ireland. (Source: Intel Corporation)

The transaction with Apollo allows Intel to unlock and redeploy to other parts of its business a portion of the investment from Apollo while continuing the build-out of Fab 34, the investment firm said in June.

Earlier this week, Apollo offered Intel an additional investment of up to $5 billion, according to a Bloomberg report.

Brookfield Asset Management also holds a stake in Intel’s fabs.

More than two years ago, Intel signed an agreement with the infrastructure affiliate of Brookfield to provide Intel with an expanded pool of capital for manufacturing buildouts.

Under the agreement, Brookfield and Intel jointly invested about $30 billion in two Intel fabs at its Ocotillo campus in Chandler, Ariz., with Intel funding 51% and Brookfield funding 49% of the total project cost.

Asset managers like Apollo and Brookfield expect a return of at least 18% on their investments.

U.S. taxpayers may also take a stake in Intel.

In March, the U.S. government, through the CHIPS Act, made a preliminary offer of up to $20 billion in loans and subsidies to Intel. The CHIPS Act aims to revive the shrinking U.S. semiconductor industry. The U.S. government will award CHIPS Act subsidies to chipmakers that are able to meet a series of milestones that include advancements in process technology and production capacity.

On Sept. 16, Intel announced it was awarded up to $3 billion in direct funding under the CHIPS Act for the U.S. government’s Secure Enclave program, aimed at creating a secure supply of leading-edge semiconductors for the nation’s military.

“We believe the U.S. government and the tech ecosystem are incentivized to have Intel as a viable manufacturer of leading-edge chips,” SemiAnalysis analyst Christopher Seifel told EE Times. “While Intel is already making tough strategic decisions given its cash constraints, the U.S. government and tech partners could likely develop creative solutions to ensure Intel can continue as a reliable leading-edge foundry partner.”