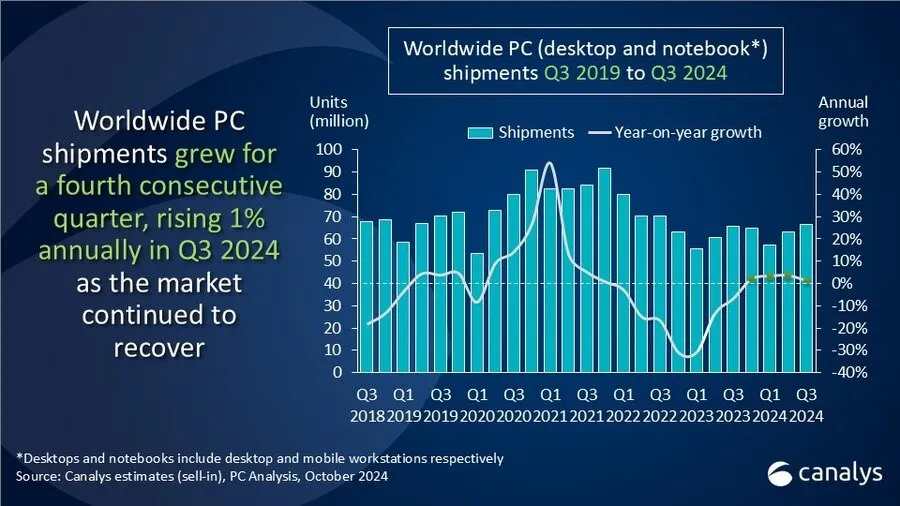

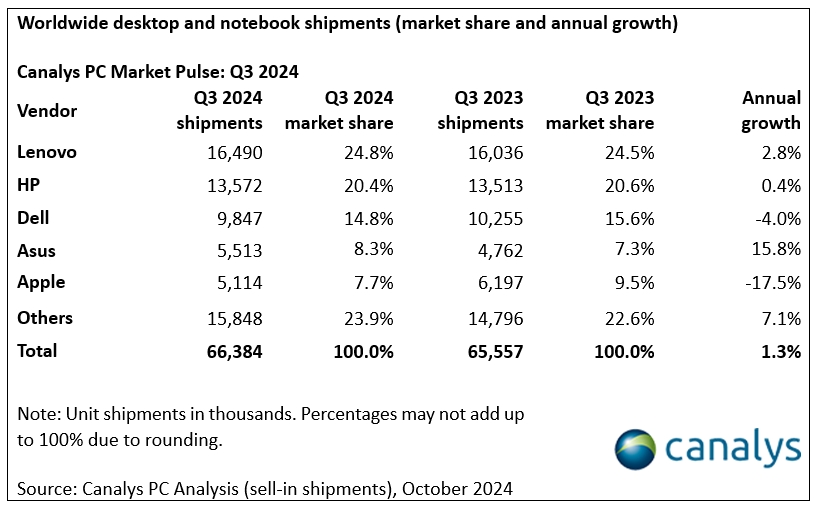

The global PC market grew year on year for a fourth consecutive quarter, with total shipments of desktops, notebooks and workstations up 1.3% to 66.4 million units, according to the latest Canalys data.

Notebook shipments (including mobile workstations) reached 53.5 million units, up 2.8%, while desktop shipments (including desktop workstations) contracted 4.6% to 12.9 million units. The next 12 months are set for continued strong growth as a large proportion of the Windows PC installed base still needs to be refreshed before the end of life of Windows 10 in October 2025.

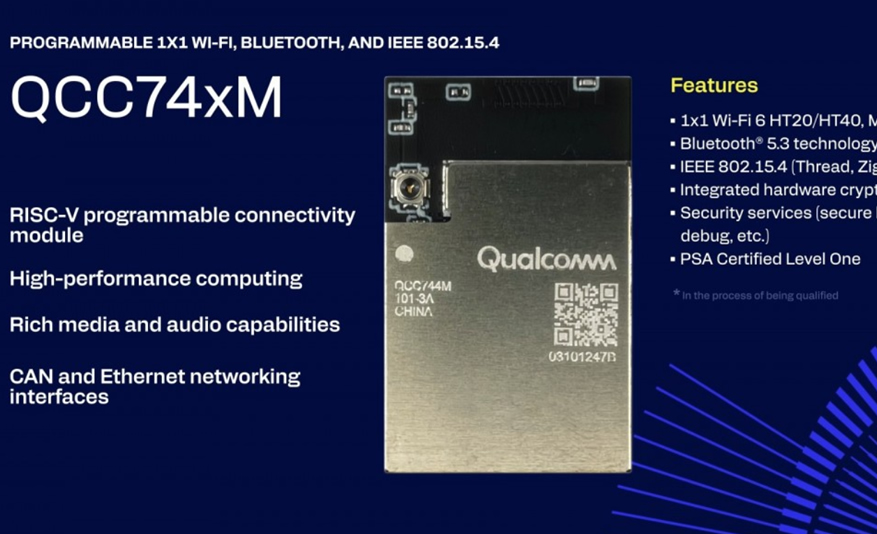

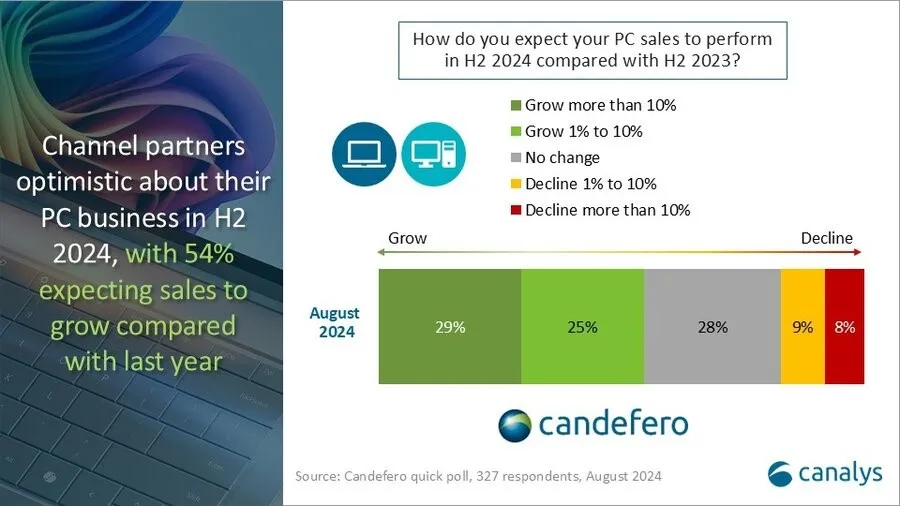

“Although growth in Q3 was modest, the PC market recovery is now well underway with a number of positive signals indicating stronger performance in the coming quarters. The uptick in demand has been especially strong from businesses, which now have just a year to upgrade their fleets to Windows 11 and avoid paying extended support fees. Commercial procurement is expected to remain elevated throughout the rest of this year, with 54% of channel partners surveyed by Canalys anticipating growth in their PC business in H2 2024 compared with the same period last year. The launch of the latest-generation AI PC processors from Intel, AMD and Qualcomm is also strengthening the value proposition of upgrading an old PC. Consumer demand has not been as strong, but the 2024 holiday season is expected to bring significant promotional activity, which will help support modest growth toward the end of this year,” said Ishan Dutt, Principal Analyst at Canalys.

Lenovo was the top vendor in 3Q 2024, shipping 16.5 million units worldwide, with 3% year-on-year growth after strong shipments in 3Q 2023. HP followed in second place with flat growth, shipping 13.5 million units globally.

Dell held onto third position but saw its shipments fall 4% annually to 9.8 million units. Asus clinched fourth place, boasting the highest growth among the top vendors with a 16% year-on-year increase, while Apple rounded out the top five with 5.1 million Macs shipped.