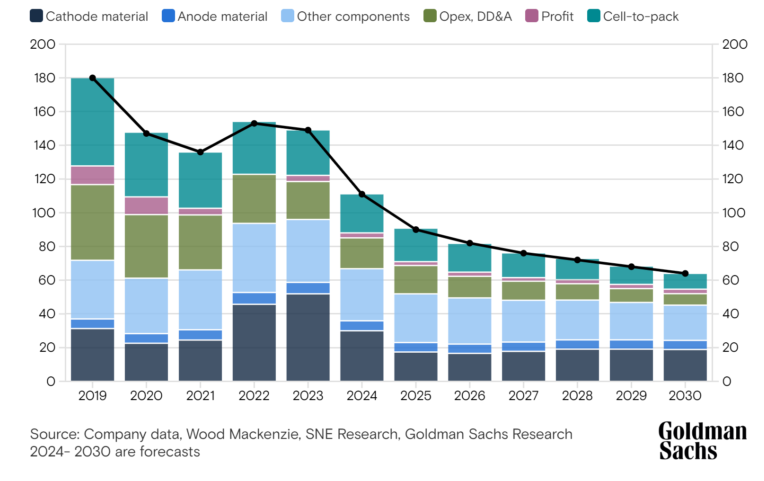

Research by Goldman Sachs is predicting the cost of EV batteries will fall to $80 per kilowatt hour in the next two years.

Global average battery prices declined from $153 per kilowatt-hour (kWh) in 2022 to $149 in 2023, and Goldman Sachs Research predicts this to fall to $111 by the end of 2024.

Beyond that, average battery prices could fall towards $80/kWh by 2026, which would see battery electric vehicles achieve ownership cost parity with gasoline cars in the US on an unsubsidized basis.

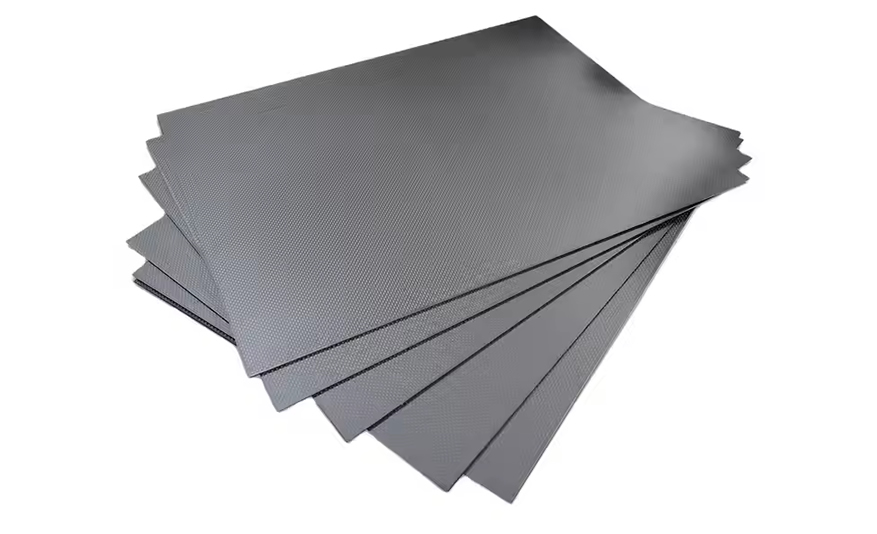

There are two main drivers, says Nikhil Bhandari, co-head of Goldman Sachs Research’s Asia-Pacific Natural Resources and Clean Energy Research. “We’re seeing multiple new battery products that have been launched that feature about 30% higher energy density and lower cost. The second driver is a continued downturn in battery metal prices. That includes lithium and cobalt, and nearly 60% of the cost of batteries is from metals. When we talk about the battery from, let’s say, 2023 to all the way to 2030, roughly over 40% of the decline is just coming from lower commodity costs.”

- Battery prices continue ot fall

The innovation is related to the structure of the batteries. The cells are getting bigger, eliminating modules and directly going to cell-to-pack architectures. That saves space and cuts costs.

“In the future solid state batteries could be a real game changer, because the technology can increase your energy density more materially and is slightly safer because there is no flammable liquid electrolyte,” he said. “We were assuming that newer batteries like solid state would capture about 5-10% of the market along with sodium ion batteries, but that hasn’t happened. Solid state was initially supposed to come out by now, and it’s been pushed out to the later part of this decade because of challenges in moving from lab scale to mass production.”

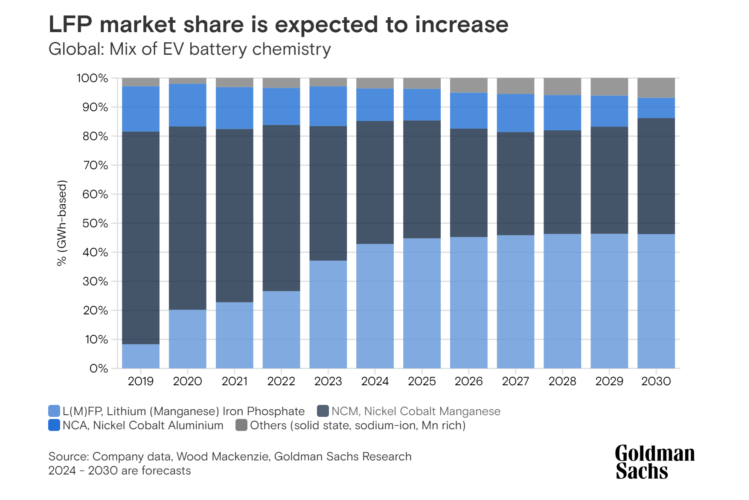

As a result Goldman Sachs has raised its expectation for LFP batteries to increase their market share from 41% of the market to 45% in 2025, with advanced nickel batteries continuing to dominate the higher energy competition.

There are five companies which control nearly 80% of the market share and each has been in the industry for over two decades, increasing their R&D spend even more aggressively in the last three to five years.

“Given that we’re still expecting a rapid fall in battery prices, and assuming a still relatively elevated oil price environment, we believe that, in markets such as the US, the total cost of ownership parity will still arrive starting in 2026. We think we’re going to see a strong comeback in demand in 2026 purely from an economics perspective. We believe 2026 is when a consumer-led adoption phase will largely begin.”