Late last week, Knowles Corporation said it reached an agreement to sell its consumer MEMS microphones business to Syntiant for $150 million following a thorough strategic review, as it continues its transformation to an industrial technology company.

Knowles has been looking to sell off its consumer MEMS microphones (CMM) business for a while, following its $263 million acquisition of Cornell Dubilier in 2023, when it announced that it was also exploring strategic alternatives for its CMM division.

According to analysts at Yole Group at the time, the overall MEMS audio industry flourished over the last two decades, but the influx of plenty of competition from companies like Infineon Technologies, TDK Invensense, MEMSensing, STMicroelectronics, AAC Technologies and others meant Knowles lost its number one slot in MEMS microphones. Design wins from companies like the Chines Goermicro in several Apple, Samsung and Xiaomi smartphones and wearables also impacted Knowles’ market lead, according to research conducted by Yole in September 2023.

Some people in the industry that I spoke to since the announcement of the sale commented that the combination of Knowles desire to sell and Syntiant’s cash status made it possible to pick up the CMM business as a “distressed asset.”

Syntiant was approached for comment on its broader strategy but did not respond at the time of publication. In a prepared statement, CEO Kurt Busch said, “We believe almost every microphone of the future will be AI-enabled, as large language models continue to revolutionize industries by improving natural language understanding and automating complex tasks. This acquisition will clearly strengthen our product portfolio, tapping into a multi-billion-dollar MEMS market, at the same time enabling Syntiant to offer comprehensive, end-to-end solutions that integrate sensors [microphones], processors and high-performance machine learning models, uniquely positioning Syntiant as the premier provider for AI-driven interfaces.”

“Whether in autonomous vehicles, smart home devices, or industrial automation, a significant number of Syntiant NDP deployments will continue to have a microphone, enabling next-generation AI features like voice commands, speech recognition, echo cancellation, background noise suppression, wake word detection and audio event detection,” Busch added. “With this transaction, we also are grateful to be gaining a very talented team with proven technology, world-class multinational operations, and long-term customer relationships serviced around the globe. We look forward to welcoming them to the Syntiant family.”

In the company’s statement, Knowles noted the sale of its CMM business supports its “continued transformation into an industrial technology company,” consisting of its precision devices and MedTech and specialty audio segments, primarily serving the aerospace, defense, MedTech, industrial and electrification markets. On a pro-forma basis, the remaining Knowles businesses, inclusive of Cornell Dubilier’s full year results, had $560 million of revenue in 2023.

“Today’s announcement represents another significant milestone in Knowles’ transformation into a premier industrial technology company, building upon the success of our recent Cornell Dubilier acquisition,” Knowles’ chief executive officer, Jeffrey Niew, said in the statement.

Syntiant will pay $70 million in cash and $80 million in Syntiant preferred stock for Knowles’ CMM business, which generated revenues of $256 million in 2023 and $136 million in the first half of 2024.

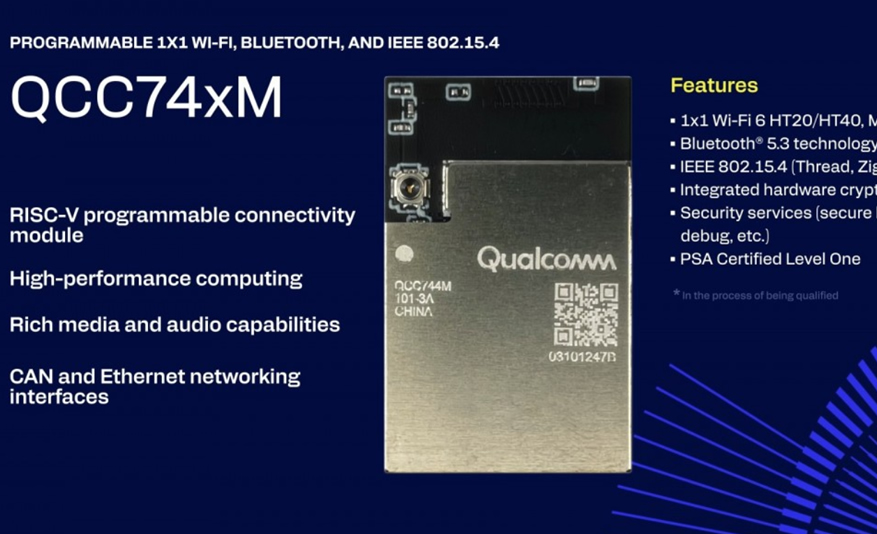

Earlier this year, Syntiant was one of the AI chip partners announced as part of TDK InvenSense’s sensor partner program, in which partners offer reference designs, evaluation kits, modules and software algorithms with InvenSense MEMS sensors to help build IoT solutions. Other chip partners in this program are Ambarella with its AI vision SoCs and AONDevices with its voice activation SoCs.